Intro

Investors have been facing a special kind of challenge in 2025. Although stocks and bonds have been a common addition to wealth-building plans in the past, this is not the case in the current market environment. The value of fiat currencies is being tested by unpredictable fluctuations, increased inflation, and geopolitical tensions, creating an environment where their value is being put to the test.

These aspects constitute an essential source of pain among many investors: the failure to use conventional asset classes to remain stable and save money. Stocks and bonds, which were once regarded as solid constituents of an investment portfolio, now appear to be riskier since the world markets are volatile. Another looming issue is inflation that diminishes purchasing power. An increase in inflation reduces the worth of the dollar and hence most of the purchases one may make on a daily basis will be costly, and the cash holdings will be weakened.

With this unpredictable weather, investors are seeking other assets that can provide them with inflation safety and long-term growth. The Krugerrand Gold Coins will offer a strategic answer to these issues.

Introducing Krugerrand Gold Coins: A Time-Tested Solution

The South African Mint first minted the gold bullion Krugerrand in 1967 and is known to be the first modern bullion coin in the world. One of its aims was to facilitate the use of gold by the general population, and it soon emerged as a favorite investment tool all over the world. It has a design (a blend of the South African springbok antelope and the profile of Paul Kruger, the former president of South Africa) that has not only helped to signify the richness of the history of South Africa but also to symbolize its economic power.

The Krugerrands are made of 22-karat gold, implying that they have an addition of copper to increase durability. The coins usually weigh one ounce, but they are also available in fractional amounts such as 1/2 oz, 1/4 oz, and 1/10 oz, which makes them affordable to different investors who may have distinct budgets. Krugerrands are also valuable because of the quantity of gold they contain, and at the same time because they are very liquid due to the large amount of coins produced.

Key Advantages of Investing in Krugerrand Gold Coins

a. Global Recognition and Liquidity

The Krugerrand Gold Coin boasts of one of the most distinctive attributes, which is that it is universally recognized. They rank among the most commonly traded gold coins in the market, with millions of Krugerrands sold since their introduction to the market. They are very liquid by their established reputation as investors can easily buy and sell them at favourable prices.

Such liquidity is also necessary to investors who need flexibility during volatile times in the financial climate. Krugerrands offer the chance to grab your fortune when it is required, regardless of whether you are cashing in because you want to or make use of a market opportunity.

b. Affordability and Accessibility.

Krugerrands generally have a lower premium over the spot gold price than other gold coins such as the American Gold Eagle or the Canadian Gold Maple Leaf. This will ensure that they are a friendly investment option for investors who wish to invest in gold without incurring high premiums. In the case of investors who prioritize quantity over quality, the Krugerrand offers a money-saving balance and preserve value.

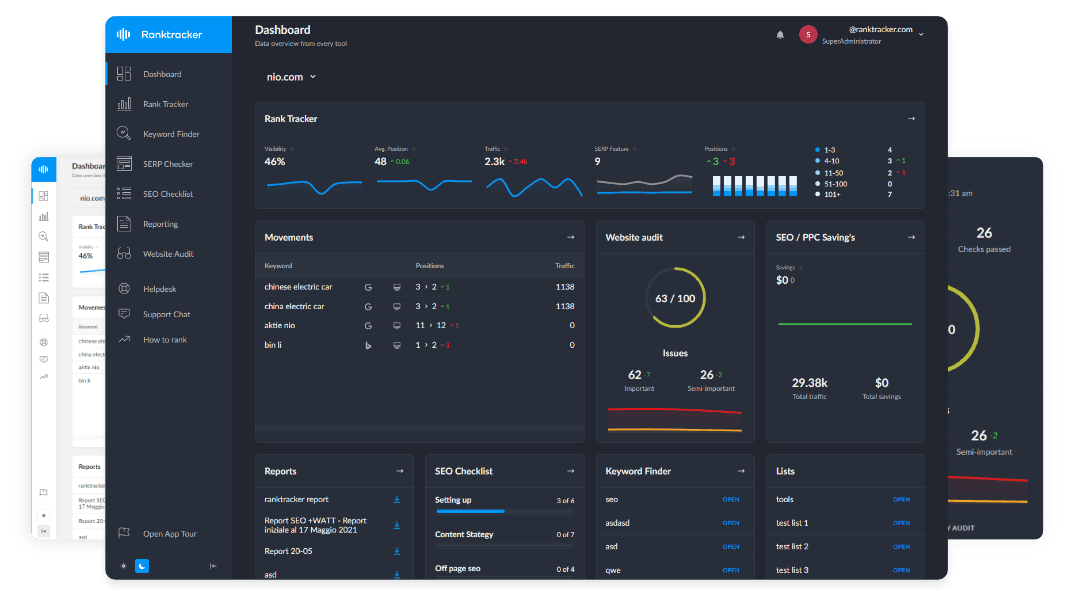

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

It is the accessibility of the Krugerrand that makes it quite attractive to both new and experienced investors. You don't even need to buy in bulk to enjoy rising gold prices. The precious metals market can be satisfactorily exposed with even an investment in a couple of Krugerrands.

c. Durability and Longevity

Gold is commonly used as a long-term investment. The 22-karat Krugerrand Gold Coin is a good investment in terms of value and longevity. The process of alloying copper gives the coin its strength and makes it less susceptible to scratches and wear unlike the 24-karat pure gold coins. This not only makes it a great store of value but also a convenience which will retain its appearance and value with time.

The Krugerrand has both aesthetic and practical advantages to investors who would like to own a tangible asset that withstands over time. It is durable and thus the coin will be in good condition even after many years of handling hence it makes it a good long-term investment.

How Krugerrands Fit Into a Diversified Investment Strategy

Safeguarding against inflation is a key problems of investors in 2025, and Krugerrand Gold Coins can make a significant contribution to this issue. Gold has been used as a hedge against inflation and the price of the commodity tends to increase when the value of fiat currencies depreciates. This implies that Krugerrands is a good solution to investors who want to secure their purchasing power amidst an inflationary economy.

Besides inflation protection, Krugerrands have the benefit of diversification. Major financial markets like stock and bond markets tend to be highly volatile. Gold on the other hand has a track record of performing well when other assets are not performing. Therefore, Krugerrands can be used in your portfolio to create a stabilizing influence that can be used to reduce the overall risks and volatility.

The Krugerrand is a flexible instrument to the investor wishing to protect his wealth. That is whether you possess it as a physical asset or a precious metals IRA, it can be used to offset more volatile asset classes.

Why Krugerrands Are the Ideal Investment for Wealth Protection in 2025

In the current economic environment, wealth protection is the primary concern of various investors. The unpredictability of the stock market and increased inflation can render the reliability of conventional investment avenues questionable, particularly in terms of stability and wealth protection. The Krugerrand Gold Coin, however, offers a secure investment platform to investors who desire to protect their assets against the vagaries of an economy.

Gold has always had an intrinsic value of its own and its implementation as a store of wealth is an unparalleled one. During financial crises, gold tends to retain or appreciate in value and therefore is a sure way of preserving purchasing power. Krugerrands are an easy and convenient source to add this essential asset to your portfolio.

Like tracking your portfolio, you can also track the rank of your website with our **Rank Tracker **and find your best-performing pages with our SERP Checker!

When you add Krugerrand Gold Coins in your investment strategy, you will be so sure that your wealth will be saved against the degrading influences of inflation and market variability. The ease of liquidity and the market value of this coin and its affordability make the coin interesting to every investor.

Conclusion

The stability demanded in investment portfolios is more than ever to move through 2025. The Krugerrand Gold Coin is a viable, practical way to overcome the adversities of inflation, market instability and even geopolitics. A Krugerrand is a wise investment choice whether you are an expert or novice investor using precious metals because it is a cost-effective method to diversify your portfolio and hedge your assets.

Having Krugerrand Gold Coins in your portfolio is not merely a matter of having a hedge against monetary insecurity--it is a matter of having a portfolio to build on in later years. These coins remain a potent instrument in the strategy of any investor, thanks to their international fame, liquidity, and affordability.