Intro

If it’s ever crossed your mind why some real estate investors consistently find the best deals while others seem to hit roadblocks, the answer usually goes beyond just knowing the market. A big part of the success comes down to having the right support team, especially when dealing with the tricky details of property taxes and financial planning. Articles about real estate taxes often point out just how complicated and varied property tax rules can be, changing with location and property type. This is precisely where accounting professionals with real estate expertise step in, providing customized guidance that helps investors pick the right properties and organize their portfolios for both growth and protection.

Why Property Taxes Are More Than Just a Bill

Property taxes might feel like just another expense, but they have a huge impact on the overall profitability of an investment. What’s tricky is that tax regulations are rarely one-size-fits-all. Each municipality sets its own rules, and these can change depending on the property’s classification, intended use, or even recent changes in zoning. For investors, overlooking the nuances in property taxes can turn a seemingly promising deal into a financial headache.

An accounting professional brings clarity to this maze. They know where the potential tax savings are hiding, which deductions apply, and how to forecast property tax liabilities accurately. Understanding these details before buying can save investors from unpleasant surprises later and help shape a strategy that aligns with their financial goals.

The Role of an Accountant in Property Selection

Choosing which properties to invest in involves more than location scouting and market trends. The financial picture, including how a property’s taxes will affect cash flow and net returns, plays a huge role. This is where specialized accountants step in, analyzing not only the purchase price but also the ongoing tax obligations, maintenance costs, and depreciation schedules.

Accountants experienced in real estate understand the subtleties that general financial advisors might miss. They can model different scenarios, comparing how various properties will perform under different tax codes and investment timelines. This kind of analysis helps investors prioritize properties that not only fit their business plan but also offer optimal tax efficiency.

Portfolio Expansion with Tax Efficiency in Mind

Expanding a real estate portfolio is a major step that requires thoughtful planning. It’s not just about buying more properties but about creating a balanced, resilient collection of assets that work well together financially. Accounting professionals assist in mapping out expansion strategies that maximize income and capital gains while minimizing tax burdens.

For example, diversifying property types or investing across multiple jurisdictions can offer tax advantages. However, this complexity demands expert advice to avoid compliance pitfalls. Accountants guide investors on structuring ownership through entities such as LLCs or trusts, helping to shield assets and optimize tax outcomes.

Navigating Multi-Jurisdictional Tax Compliance

For investors operating across regions or countries, staying compliant with different tax regulations is a challenge that cannot be underestimated. Each jurisdiction may have its own filing requirements, deadlines, and reporting standards. Missing even a small detail can result in penalties or legal complications that eat into profits.

Accounting professionals skilled in real estate taxation are well-versed in managing these diverse requirements. They ensure that investors meet all local, state, and federal obligations, no matter where their properties are located. This comprehensive compliance support is vital for maintaining good standing with tax authorities and avoiding costly errors.

Continuous Support Beyond Tax Season

One of the biggest misconceptions is that accountants are only useful during tax season. In reality, real estate investors benefit most from ongoing consultation throughout the year. Markets shift, tax laws evolve, and business goals change. Regular check-ins with an accounting professional keep strategies aligned with current conditions.

This ongoing relationship also means investors can tackle unexpected tax issues promptly, make informed decisions about new acquisitions, and optimize financial reporting for better insights. The continuous education and personalized advice provided help investors feel confident navigating an often complex and fast-moving landscape.

How to Choose the Right Accounting Partner for Real Estate

Finding an accountant who understands real estate investing is crucial. Not all accountants have the same level of expertise in property taxes, investment structures, or compliance nuances. When seeking the right partner, it’s important to look for professionals with proven experience in real estate and a track record of working with investors.

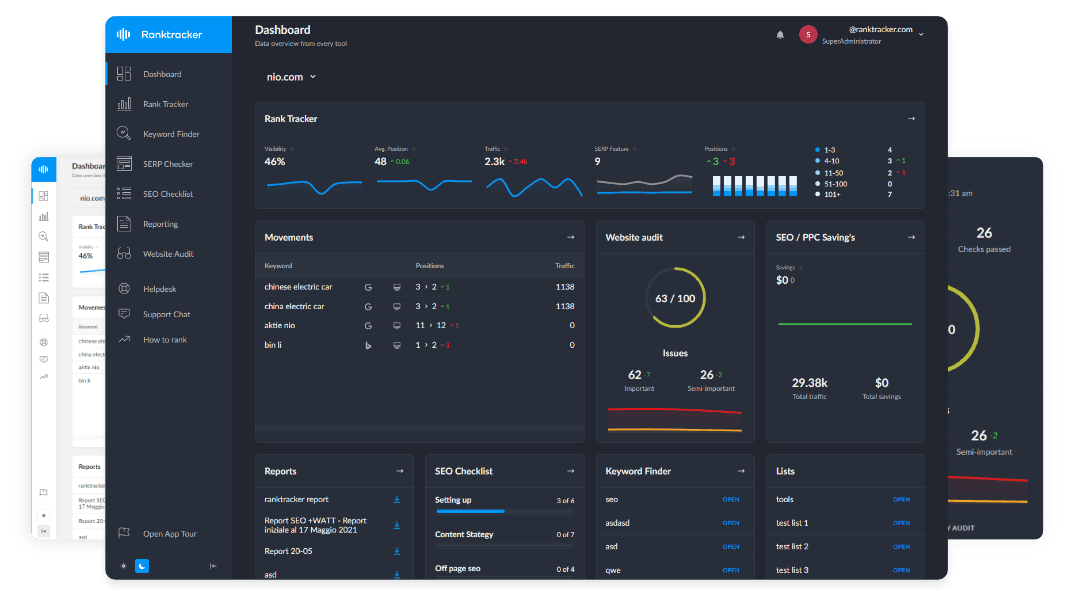

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Additionally, communication style matters. Investors need someone who explains complex tax matters in clear, practical terms and offers proactive advice tailored to their goals. Trust and accessibility are key because the relationship goes beyond number crunching, it’s a partnership for long-term financial success.

Turning Tax Complexity Into Strategic Advantage

Property taxes and financial regulations might never become simple, but with the right expertise, they can transform from a source of stress into a strategic advantage. Accounting professionals serve as navigators through this complicated terrain, helping investors identify the best properties, plan expansion thoughtfully, and maintain full compliance.

Real estate investing is as much about managing risks and costs as it is about finding great locations. The difference often lies in who is guiding the financial decisions behind the scenes. For investors serious about growing their portfolios wisely and sustainably, working with specialized accounting experts isn’t just a luxury, it’s an essential part of success.

Final Thoughts

If you ever wondered how to pick properties that not only look good on paper but also fit your financial goals, partnering with an accounting professional specializing in real estate is a smart move. Their tailored advice goes far beyond taxes, offering insights into portfolio growth, asset protection, and compliance that make a real difference.

Managing property taxes effectively requires more than occasional help; it demands a trusted ally who understands the unique challenges of real estate investing and offers continuous support. With the right guidance, investors can build stronger, more profitable portfolios while confidently navigating the ever-changing tax landscape.