Intro

The allure of making money while you sleep has captivated countless individuals seeking financial freedom. Despite what social media influencers might suggest, truly passive income rarely happens overnight and almost always requires significant upfront investment—either in time, money, or specialized skills.

Creating sustainable passive income streams requires patience, strategy, and realistic expectations. Just as experienced gamblers understand that consistent profits at platforms like ICECasino require knowledge of game mechanics and disciplined bankroll management, building passive income demands understanding the underlying principles and committing to a long-term approach. Let's separate fact from fiction and explore passive income strategies that genuinely work.

Understanding True Passive Income

The term "passive income" has become somewhat misleading in modern discourse. While the dream of completely hands-off earnings is enticing, most successful passive income strategies require ongoing maintenance and oversight.

What Passive Income Really Means

True passive income involves earning money from assets or ventures that require minimal day-to-day involvement. However, these streams typically demand substantial initial effort or investment. Even the most hands-off income sources require periodic attention to maintain profitability and relevance.

The Internal Revenue Service (IRS) defines passive income as earnings from either rental activity or a business in which the earner does not materially participate. This technical definition helps distinguish between active business income and truly passive revenue sources.

Common Misconceptions

Many aspiring entrepreneurs fall victim to unrealistic expectations about passive income. The most prevalent misconceptions include:

- Instant Results: Genuine passive income streams typically take months or years to develop before generating meaningful revenue

- Zero Effort: Nearly all passive ventures require regular maintenance, strategy adjustments, or content updates

- Easy Money: Most successful passive income earners invested significant time developing skills, building assets, or accumulating capital before seeing returns

Understanding these realities helps set appropriate expectations and prevents discouragement when immediate results don't materialize.

Real Estate Investment Strategies

Real estate remains one of the most reliable passive income sources, though the level of involvement varies significantly depending on your approach.

Rental Properties: Active vs. Passive Approaches

Traditional rental property ownership sits in a gray area between active and passive income. While rental income flows regularly, landlords often face tenant issues, maintenance demands, and property management responsibilities.

The truly passive approach to real estate investing typically involves hiring property management companies to handle day-to-day operations. This reduces personal time investment but also cuts into profit margins, typically costing 8-12% of monthly rental income.

REITs and Real Estate Crowdfunding

For those seeking real estate exposure without direct property ownership, Real Estate Investment Trusts (REITs) and crowdfunding platforms offer accessible alternatives. These options allow investors to participate in real estate markets with significantly lower capital requirements and virtually no management responsibilities.

| Investment Type | Minimum Investment | Average Annual Returns | Liquidity | Passive Level |

| Direct Rental Property | $20,000-50,000+ down payment | 5-10% cash flow + appreciation | Low | Moderate |

| REITs | $10-1,000 | 7-12% total return | High | Very High |

| Real Estate Crowdfunding | $500-10,000 | 8-15% | Low-Medium | High |

| Mortgage Notes | $10,000+ | 4-8% | Low | High |

The appropriate real estate investment vehicle depends on your available capital, risk tolerance, and desired level of involvement. REITs offer the most passive approach but typically provide lower returns than direct ownership during strong markets.

Digital Product Creation and Monetization

The digital economy has opened numerous passive income opportunities that leverage scalable digital products.

Online Courses and Information Products

Creating comprehensive online courses or information products requires substantial upfront effort but can generate revenue for years with minimal maintenance. Successful course creators typically spend 3-6 months developing content before seeing significant returns.

The key to success lies in addressing specific problems for clearly defined audiences. Courses teaching marketable skills or solving expensive problems tend to perform best, while oversaturated topics face fierce competition.

Software and App Development

Software as a Service (SaaS) products and mobile applications represent higher-barrier passive income opportunities. While development requires specialized skills or significant investment, successful digital products can generate subscription revenue or advertising income with minimal ongoing costs.

Most successful software entrepreneurs spend 6-18 months developing their products before achieving meaningful passive revenue. The technical nature of this path makes it less accessible but potentially more profitable than content-based approaches.

Content Creation and Monetization

Content-based passive income streams have democratized earning opportunities for creators with valuable knowledge or entertainment skills.

Blogs, YouTube, and Podcasts

These platforms enable creators to build audiences and monetize through advertising, affiliate marketing, and product sales. While content creation itself requires active work, established channels can generate revenue from previously published content.

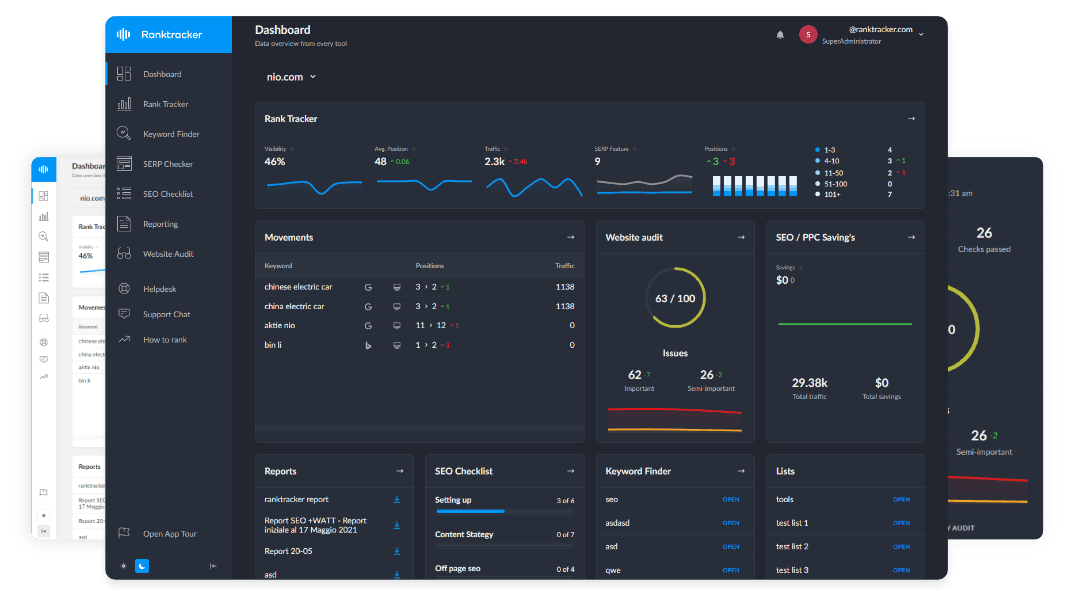

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

The reality of content monetization involves a significant delay between creation and profitability. Most successful content creators publish consistently for 1-2 years before their platforms generate meaningful passive income. During this building phase, creators typically earn little to nothing while establishing their audience.

Affiliate Marketing Realities

Affiliate marketing—earning commissions by promoting other companies' products—can eventually become passive, but rarely starts that way. Successful affiliate marketers typically build substantial traffic channels through SEO, email lists, or social media before seeing significant commission revenue.

The most sustainable affiliate marketing approaches focus on solving problems and providing genuine value rather than aggressive sales tactics. This approach builds trust and creates long-term passive income potential as older content continues generating commissions.

Investment-Based Income Streams

Traditional investment vehicles remain reliable sources of passive income, particularly for those with existing capital.

Dividend Stocks and ETFs

Dividend-focused investing offers perhaps the most truly passive income avenue. By purchasing shares in companies that regularly distribute profits to shareholders, investors can create reliable income streams without ongoing effort beyond portfolio rebalancing.

Building meaningful dividend income requires significant capital—typically generating only 2-4% annually on invested amounts. Most successful dividend investors spend years or decades accumulating positions before living off the resulting income.

Bonds and Fixed-Income Securities

For more conservative investors, bonds and fixed-income securities provide predictable passive income with lower volatility than dividend stocks. These instruments typically offer lower returns in exchange for reduced risk and greater stability.

Corporate bonds, municipal bonds, and Treasury securities all offer varying yields and risk profiles, creating a spectrum of passive income options suitable for different investor needs.

Building Realistic Passive Income

The most successful passive income strategies combine multiple approaches tailored to your available resources, skills, and risk tolerance. Rather than seeking overnight success, focus on gradually building income streams through consistent effort and investment.

Remember that true financial freedom rarely comes from a single passive income source but rather from a diversified portfolio of revenue streams. Start with the approaches best aligned with your existing strengths—whether that's available capital, specialized knowledge, or creative abilities.

What passive income strategy aligns with your current resources and goals? Consider starting with one method from this article and giving it the time and attention it deserves. Share your experiences or ask questions about specific approaches to join the conversation around building sustainable passive income.