Intro

Maneuvering the tax landscape is like walking a tightrope—one misstep can send you tumbling. As a creative entrepreneur launching online courses, you've got to be mindful of your tax obligations while maximizing your deductions. From understanding income and sales tax to keeping your records in order, there's a lot to contemplate. You might be surprised by the potential savings hiding in your business expenses. What strategies can you implement to guarantee you're not leaving money on the table? Let's explore the essentials that can safeguard your financial future.

Understanding Your Tax Obligations

When it comes to running your creative business, understanding your tax obligations is fundamental for maintaining financial health. You need to grasp the specific requirements that apply to your online courses, as tax regulations can vary based on your business structure and location.

First, familiarize yourself with the different types of taxes you may be liable for, such as income tax, sales tax, and self-employment tax. Depending on your revenue and state laws, you might need to collect sales tax on course sales. It's essential to register with your state and understand the rates applicable to your offerings.

Next, consider the significance of keeping accurate records. Document all income and expenses related to your business so that you can easily report your earnings and claim any potential deductions when filing your taxes. This practice not only simplifies your tax preparation but also helps you avoid penalties from the IRS.

Lastly, staying informed about tax deadlines is critical. Missing a deadline can lead to fines or interest charges, so make a calendar and mark all important dates. By proactively managing your tax obligations, you'll guarantee a smoother financial operation for your creative business.

Deductible Business Expenses

Understanding deductible business expenses can greatly reduce your taxable income and keep more money in your pocket. As a creative entrepreneur launching online courses, it's essential to identify which expenses you can deduct. Common deductible expenses include costs related to your course creation, such as software subscriptions, website hosting, and marketing fees.

If you hire contractors or freelancers to assist with content development or technical support, those payments are deductible as well.

Additionally, consider expenses for your workspace. If you work from home, you might qualify for the home office deduction, which allows you to deduct a portion of your rent or mortgage, utilities, and internet costs based on the size of your workspace.

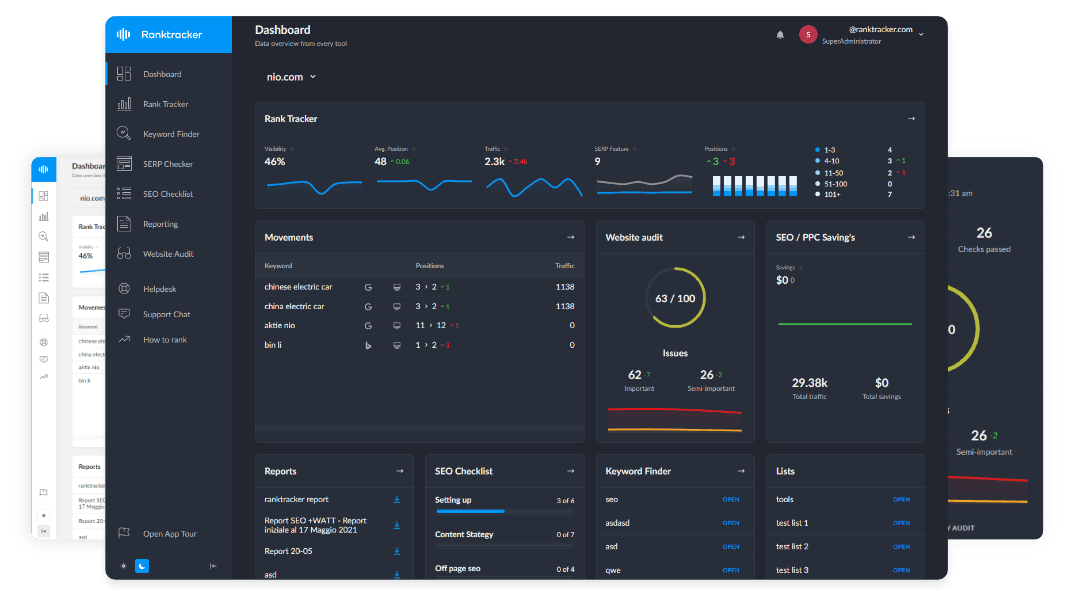

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Don't forget about education and training expenses. If you invest in courses or workshops to enhance your skills, those costs can also be deducted.

Tax Benefits of Course Creation

Creating online courses not only allows you to share your expertise but also presents significant tax benefits that can enhance your financial strategy. When you develop a course, you're engaging in a business activity, which means you can take advantage of various deductions.

One key benefit is the ability to deduct expenses directly related to course creation. This includes costs for software, website hosting, marketing, and any educational materials you purchase.

Additionally, if you use your home office as a workspace, you can claim a portion of your home expenses, like utilities and internet, as business deductions.

Furthermore, you can write off any professional development costs aimed at improving your teaching skills or content creation abilities. This might cover workshops, conferences, or even consulting fees.

Managing Sales Tax Compliance

Maneuvering sales tax compliance can feel intimidating for creative entrepreneurs, but staying informed and organized is vital.

First, understand that sales tax regulations vary by state and even local jurisdictions. Determine where your customers are located, as this will influence your tax obligations. If you sell to customers in multiple states, you may need to collect sales tax based on the buyer's location, particularly if you meet a nexus threshold.

Next, familiarize yourself with the specific rules governing digital products or services in your target states. Some states may exempt online courses from sales tax, while others may not.It's important to review state tax websites or consult a tax professional to clarify these details. If you're expanding internationally or targeting the Middle East, consider connecting with Saudi tax & setup experts at CreationBC to navigate regional regulations and business structuring efficiently.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

To simplify compliance, consider using sales tax software that integrates with your e-commerce platform. These tools can automatically calculate the appropriate sales tax for each transaction, minimizing errors.

Additionally, stay updated on any changes in sales tax laws, as they can change frequently.

Lastly, remember to file your sales tax returns on time to avoid penalties. By proactively managing sales tax compliance, you'll guarantee your creative venture remains financially sound and legally compliant.

Record Keeping Best Practices

Effective record keeping is essential for creative entrepreneurs looking to maintain financial clarity and guarantee compliance with tax regulations. To achieve this, start by organizing all financial documents, including invoices, receipts, and bank statements. Use digital tools like accounting software to streamline the process; these platforms can automatically categorize expenses and generate reports, making your life easier during tax season.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Next, establish a consistent routine for updating your records. Set aside time weekly or monthly to review and input financial data. This habit prevents the accumulation of paperwork and helps you stay on top of your finances.

Don't forget to keep personal and business expenses separate; this distinction simplifies tax deductions and reduces the risk of audits.

Additionally, maintain a system for tracking income from your online courses. Record sales, refunds, and affiliate earnings systematically. Regularly reconcile your accounts to verify accuracy and promptly address discrepancies.

Finally, back up your records securely, either through cloud storage or external drives. This safeguard protects your data against loss and ensures you have everything you need should the IRS come knocking.

Conclusion

In conclusion, maneuvering tax strategies as a creative entrepreneur launching online courses might feel overwhelming, but you don't have to go it alone. By understanding your tax obligations, maximizing deductible expenses, and ensuring compliance with sales tax, you can set yourself up for financial success. Remember, keeping detailed records and utilizing accounting software can make the process smoother. Embrace these strategies, and you'll find that managing your taxes can become a straightforward part of your entrepreneurial journey.