Intro

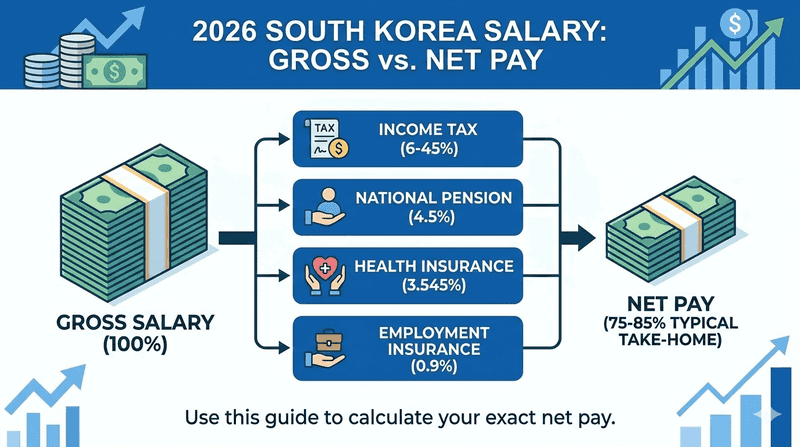

In 2026, workers typically take home 75-85% of their gross salary after deductions for income tax (6-45%), national pension (4.5%), health insurance (3.545%), and employment insurance (0.9%). Use this guide to calculate your exact net pay.

How much will you earn in Korea in 2026 as take-home pay? The Korea Pay Calculator 2026 assists in finding out the net wage after all the compulsory deductions, such as the income tax, national pension, health insurance, and employment insurance. You will never have to wonder how your paycheck was.

What is the Korean Pay Calculator 2026?

The Korea Pay Calculator 2026 is a premium salary calculator Korea tool that will transform your gross to net pay by considering all Korean payroll deductions. Compared to normal generic calculators, this calculator is powered by updated tax rates in Korea 2026 and current tax holders in Korea, and will provide you with the correct values.

When an offer of employment appears in Korea, the salary offered is never net. The reality, according to your take-home pay calculator, is what is actually deposited in your bank account after the Korean government is finished taking its portion.

How Do Korean Pay Deductions Operate?

There are amounts that Korean employers do not pay you:

- Progressive rates of Korean income tax (between 6% and 45%).

- Local income tax in Korea (10% of your income tax)

- National pension (4.5% of regular monthly earnings)

- Health insurance (3.545%, including long-term care)

- Employment insurance (0.9% of gross salary)

These deductions have very serious consequences on your gross-to-net salary. Even the annual salary paid of 50 million won does not imply you will earn the entire amount in a month.

How To Calculate Your Net Salary in Korea (2026)

One will need to know the Korean payroll system to calculate their salary after tax in Korea. The step-by-step procedure is as follows:

Step 1: Determine your gross monthly salary. You should divide your annual salary by 12. Assuming a salary of 48 million won a year, then your gross monthly salary is 4 million won.

Step 2: Calculate National Pension Divide your income by 4.5%. At 4 million won, it is 180,000 won less every month.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Step 3: Calculate Health Insurance. Multiply the gross by 3.545%. This has long-term care insurance that is automatic.

Step 4: Calculate Employment Insurance. Pay the gross salary at a rate of 0.9% as insurance against unemployment.

Step 5: Calculate income tax and go through the 2026 progressive tax brackets. The first 14 million won is subject to tax at a rate of 6%, and the second 36 million at a rate of 15%, etc.

Step 6: Add local income tax. Multiply your income tax value by ten percent. This resident tax in Korea is sent to the local municipality.

Paycalculator.ai is your net pay calculator that instantly automates these complex calculations.

Explain the 2026 Korean Tax Brackets

The knowledge of the current tax brackets in the Korean market can guide your finances. The taxation system in Korea is a progressive tax in which the larger the share of the income one earns, the higher the tax.

| Annual Taxable Income (KRW) | Tax Rate | Tax on Bracket |

| Up to 14 million | 6% | Progressive |

| 14-50 million | 15% | Progressive |

| 50-88 million | 24% | Progressive |

| 88-150 million | 35% | Progressive |

| 150-300 million | 38% | Progressive |

| 300-500 million | 40% | Progressive |

| Over 500 million | 45% | Progressive |

These are the 2026 tax rates on your after-tax deduction income. The effective tax rate will never exceed your marginal rate.

Which Deductions Reduce Your Taxable Income?

Smart employees reduce their Korean tax withholding using legitimate deductions:

- Credit card usage (15-30% of spending)

- Insurance premiums (life and disability policies)

- Medical expenses (exceeding 3% of income)

- Education expenses (for yourself or dependents)

- Housing savings (청약저축)

- Pension contributions (beyond mandatory amounts)

These deductions will be reflected in your annual tax filing, but they do not have an impact on your monthly paycheck calculator withholding. You get back refunds by making taxes in May.

Korean Pay Calculator for Foreigners and Expats

Foreigners who work in Korea are subject to the same payroll deductions as the Korean workers; however, there are some exceptions. Considerations of your expat salary calculator in Korea:

Tax Treaties India and Korea possess a tax treaty against the two sets of taxation. In certain circumstances, Indian residents who temporarily work in Korea can make claims for exemptions.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Eligible Pension Refunds: Foreign employees leaving Korea permanently may receive refunds of national pensions on their contributions during working periods. Applications are to be made within two years after leaving.

Health Insurance Eligibility: All employees are covered by Korean health insurance on an obligatory basis, irrespective of their nationality. Your dependents will be eligible to join your plan if they live in Korea.

Understand Your Korean Payslip

Where your money goes is shown just by looking at your monthly payslip. Here's what each line means:

- Gross Pay: Your full salary before any deductions

- National Pension: Retirement savings contribution

- Health Insurance: Medical coverage, including long-term care

- Employment Insurance: Unemployment protection fund

- Income Tax: Federal tax based on earnings

- Local Income Tax: Municipal tax (10% of income tax)

- Net Pay: Your actual take-home amount

Real-life Example: A software engineer in Seoul earning 60 million won per year will have an annual statement of, say, 4.2 million won monthly after deductions—not the gross amount of 5 million won as it implies.

Common Mistakes in Calculating Korean Salary

American workers in Korea usually commit the following mistakes:

Mistake 1: Neglecting Social Insurance. People pay close attention to income tax, leaving aside the pension and health insurance, which take almost 9 percent of the gross pay as a package.

Mistake 2: The offer of a gross job should not be confused with net jobs. A net-based budget is normally 75-85% of gross based on the level of income.

Mistake 3: Missing Bonus Calculations. Korean companies usually have bonuses as one-on-one payments. The Korean rule on the calculation of bonuses works the same, except that it might propel you into higher tax brackets in the interim.

Mistake 4: Failure to note that severance Pay in Korea requires severance pay (toejiggeum), which is equal to a year of average salary times a month. This is not shown in monthly calculations, but increases the total compensation greatly.

Why Does Accurate Salary Calculation Matter

The calculation of your income calculator wrongly leads to financial difficulties:

- Budget Planning Fails: Rent, expenses, and savings plans fail when pegged to the wrong assumptions in terms of income.

- Loan Applications Are Sunk: The banks today cannot monitor and grant loans based on net income.

- Surprising Tax Hits: Erroneous withholding results in prominent tax bills/lessened refunds in May.

Through an updated Korean tax calculator with new tax laws, Korea will avoid such problems all along.

Key Takeaways:

- The Korea pay calculator 2026 is a tool that would give the net salary computation with the existing tax rates and rates of social insurance.

- You can make about 75%-85% of your gross salary once all the required deductions to Korea are done.

- Your paycheck is cut down by national pension (4.5%), health insurance (3.545%), employment insurance (0.9%), income tax, and local tax.

- The deductions received by the foreign workers are the same as those of the citizens of Korea, but they are allowed to get their pensions refunded when they leave.

- You should always budget and plan on the net figure and not the gross figure in your offer letter.

Best Automated Tools for Payroll and Salary Calculation

Need to know how much pre-tax income you will bring home? Check out our best free pay calculator in Korea at Paycalculator.ai and take a look at the exact amount you will earn in 2026 under different Korean tax rates and deductions.

FAQs:

How much tax will I pay on my salary in Korea in 2026?

Your total tax burden typically ranges from 15% to 35% of your gross salary. This includes income tax, local tax (10% of income tax), national pension (4.5%), health insurance (3.545%), and employment insurance (0.9%). Higher earners face steeper rates due to progressive taxation.

Can I get a refund on my Korean national pension contributions?

Yes, foreign workers leaving Korea permanently can claim pension refunds if they contributed for less than 10 years. You must apply within two years of departure through the National Pension Service with your passport, departure proof, and bank details.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

What is the difference between gross and net salary in Korea?

Gross salary is your total pay before deductions. Net salary is what you actually receive after all taxes and social insurance are removed. The difference is typically 15-25% of gross salary, meaning you take home 75-85% of your stated salary.

Do Indian citizens pay different taxes in Korea?

No, Indian citizens pay the same taxes as Korean nationals. However, the India-Korea tax treaty prevents double taxation. You may claim foreign tax credits in India for taxes paid in Korea, depending on your residency status and income sources.