Intro

Digital technology is changing the way Canadians live in ways that wouldn’t have seemed possible a decade ago. Now everything seems easier: paying with a phone tap, checking traffic in seconds, and even investing and saving money. These innovations have made everyday finances smoother and faster. Using apps for everything, especially for the younger generations, is less of a novelty and more of a routine, an integral part of every aspect of modern life.

The rise of instant services, from e-payments to no verification casino platforms, demonstrates just how much Canadians value speed and simplicity. At the same time, questions of trust and security can't be ignored, especially with growing concerns about online scams, data leaks, and financial fraud.

So, the crucial question remains: which road is safer, the convenient or cautious? We'll analyze both sides of the conversation, exploring the perks and weighing the risks of cutting corners, guided by the insights from our expert team at CasinoOnlineCA.

Chasing Speed in a Hyper-Connected World

Digital life in Canada runs at full throttle, with almost every routine, like messaging, shopping, booking a taxi or a hotel, or reading the news, happening in moments.

Modern Canadians expect to pay for their groceries with a tap, access streaming services without delay, and sort out bills or paperwork instantly from their phones. These habits reflect a national appetite for “now,” where a few seconds saved is considered a win, and frictionless experiences are not just desired but expected.

Mobile apps, cloud services, and smart devices have made convenience the backbone of everyday routines. This rapid pace brings choices. Should users accept quicker access if it means skipping steps meant to keep their accounts and information safe? Every time a platform offers one-click sign-ups or ultra-fast onboarding, it offers a trade-off between speed and caution.

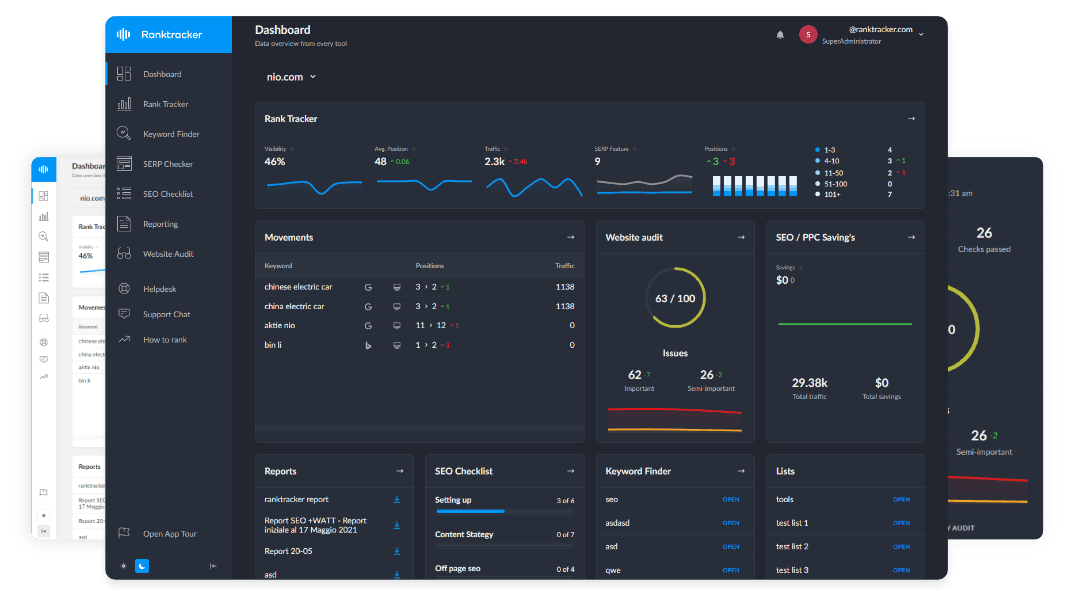

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

The pull of quick access is strong, but so are the stakes, especially as Canadians navigate digital platforms for everything from work to entertainment.

The Case for Security

Efficiency rules the digital realm of Canadians, but they are also facing new realities about digital risk. From social media scams to Wi-Fi concerns over hacking and identity theft, they have never been higher.

Many still chase speed, but more and more Canadians are pausing to check privacy settings or verify emails before clicking on a link. For some, strong passwords and multi-factor authentication are as habitual as a daily commute.

Stories of data breaches that lead to identity theft and online fraud make users pause before embracing every flashing new tool. Canadians know that protecting personal and financial information is more important than ever, especially as digital banking opens up fresh avenues for cybercrime.

“We’re seeing fintech platforms step up with stronger security measures to address growing concerns. Two-factor authentication, biometric logins, and real-time fraud alerts have become standard safeguards for users. On top of that, blockchain is emerging as a serious tool for securing transactions, offering temporary assistance records and encrypted data exchanges without relying only on traditional banks,” explains James Segrest, an author and gambling expert at CasinoOnlineCA.

“Canadian regulators like FINTRAC and OSFI are also raising the bar by requiring firms to verify customers, monitor activity, and report anything suspicious. At the same time, consumer groups are pushing hard for stronger privacy protections and clearer rights over personal data. Together, these forces let Canadians decide more about how they protect their digital lives,” Segrest adds.

Speed vs. Caution: Is There a Middle Ground?

The push and pull between speed and security in Canadian fintech has led to some creative solutions. Modern digital platforms are making strides in this direction.

Today's instant payment apps don't just process transfers in seconds, but they run background AI fraud monitoring simultaneously. Algorithms detect suspicious patterns, such as unusual spending locations or atypical transaction sizes, and quietly trigger alerts.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

In many cases, the system intervenes before users even realize there's a problem. Features like biometric logins and real-time push notifications further layer in protection. They let someone complete a grocery payment with a fingerprint scan and send immediate alerts if another person accesses their account.

Yet, while safety tools are advancing, they don't always keep pace with the speed of innovation. For instance, biometric authentication, now common in banking apps, has made passwords feel outdated, but it also introduces risk if biometric data itself is compromised.

Similarly, fraud detection AI works best when trained on massive data sets, but false positives can frustrate users who see legitimate transactions blocked. The balance is delicate. Speech should not come at the cost of security, but security measures that are too heavy-handed can erode the very convenience of digital promises.

Blockchain technology illustrates both the potential and the limits of this middle ground. On paper, it offers a secure decentralized ledger that's nearly impossible to tamper with, ideal for transparent transactions. However, the promise of blockchain security sometimes lags in practice. Hacked crypto exchanges, lost private keys, and regulatory grey zones expose users to risks that undermine the supposed safety of the technology.

The rollout of open banking and efforts to modernize digital infrastructure continue to expand fintech reach. Yet, solving these persistent barriers requires collaboration between companies, banks, community partners, and policymakers.

Ultimately, the middle ground isn't about slowing technology down but ensuring that protective measures evolve alongside, not after, the innovations that drive speed.

The Generational Divide

The debate of speed vs. caution isn't just technical, but it also runs through generations and lifestyles. Younger Canadians may lean toward rapid spin-ups and automated sharing, while older Canadians often prefer extra layers of verification and familiar routines.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

National conversations about cyber threats and digital hygiene reflect a growing awareness of their importance. Security measures like software updates or secure logins aren't just burdens but must-haves for protecting families, jobs, and personal data. As Canada's digital world speeds up, the challenge is clear: how do Canadians keep life moving quickly without leaving their safety behind?

The difference shows up clearly in everyday habits like food delivery; 67% of Canadians younger than 34 have used food delivery apps compared to just 15% in the older age group. This generational divide depicts how younger Canadians gravitate towards digital services that offer speed and simplicity, while older adults are more likely to hold back, valuing caution and a sense of control over rapid access.

The Bigger Picture

Canadians want to enjoy the benefits of frictionless payments, but they also want reassurance that the systems they trust with their savings and personal data are resilient enough to withstand today's cybercrime threats.

So, at its core, the digital transformation conversation boils down to a simple tension: speed versus caution or security. The platforms that thrive will be those that manage to deliver both. Contrary to this, companies that force Canadians to choose quick but risky or safe but slow risk losing trust in an increasingly competitive market.

The question is not whether or not the digital takeover will continue to expand because it will, but how Canadians will choose to balance their appetite for instant gratification with their demand for protection. The answer to this question will decide the future of the digital realm in Canada and determine whether speed and security can truly coexist.