Intro

If your register keeps coming up short and you can't figure out why, you're not alone. Small cash discrepancies may seem insignificant, but they add up quickly. For most retail businesses, the real issue is not theft. It is poor cash handling habits that have never been addressed. The good news is that most of these issues are easy to fix once you know what to look for.

Why Cash Handling Still Matters

You might think cash is on its way out, but that's not the full picture. Cash still accounts for a significant share of retail transactions, especially for small purchases and in industries like convenience stores, restaurants, and boutique retail. Research found the total cost of cash for retail stores ranges from 4.7% to 15.3% of revenue when you factor in labor, errors, theft, and processing time. For a store doing $500,000 a year, that's up to $76,500 in preventable losses.

Here are the five most common mistakes that could be draining your profits and how to fix them.

1. Relying on Fully Manual Cash Counting

If your entire cash process is done by hand, such as counting bills, sorting coins, filling out paper deposit slips, and manually reconciling drawers, you are spending more time and money than necessary. Manual processes are slow, error-prone, and don't scale when things get busy.

Every hour your staff spends hand-counting cash is an hour not spent helping customers or driving sales. Retail owners who switch to commercial bill counters often reduce end-of-day reconciliation from 30 minutes to under five minutes, freeing up labor for more productive tasks.

Research suggests that automating cash handling can help a retail store recoup as many as 500 labor hours per month. Even for a small operation, the time savings from a reliable bill counter or a POS system with blind cash deposit features are substantial.

Quick wins to start automating:

- Invest in a bill counter with built-in counterfeit detection

- Upgrade your POS to track cash transactions and flag discrepancies

- Use blind cash deposit features so cashiers can't see totals before counting

2. Not Training Your Team on Cash Procedures

Many store owners assume cash handling is intuitive. Simply hand over the change, close the drawer, and move on. But untrained cashiers make counting errors, fall for quick-change scams, and develop bad habits that quietly eat into profits week after week.

Retail loss is a growing issue for businesses across the country. The National Retail Federation's 2023 Retail Security Survey found that U.S. retail shrinkage hit $112.1 billion that year, with internal errors and employee-related issues contributing a significant portion. Not all of that is intentional theft. A huge chunk comes from honest mistakes by people who never learned the right procedures.

What proper cash training should cover:

- Counting back change from smallest denomination to largest

- Verifying bills before placing them in the drawer

- Announcing the tendered amount out loud

- Correctly processing voids and refunds

Make this part of onboarding and do not leave it to new hires to figure out on the job.

3. Running Without Standard Operating Procedures

If your cash handling process varies from shift to shift or employee to employee, you are inviting problems. Inconsistent operations hurt everything from customer experience to your retail search visibility. Without written, standardized procedures, there's no baseline to measure against, and discrepancies become nearly impossible to trace.

A solid cash handling policy should cover how drawers are counted at the start of a shift, when and how cash drops are made, who has safe access, and what happens when a discrepancy turns up. Think of it as your store's cash playbook.

| Area | What to Standardize |

| Drawer setup | Fixed starting amount for every shift |

| Cash limits | Maximum amount allowed in the register before a drop |

| Cash drops | Who performs them, how they're documented, who signs off |

| Safe access | Limited to specific managers with logged entry |

| Discrepancies | Clear process for reporting and investigating overages/shortages |

When everyone follows the same process, it is easier to spot errors or suspicious activity. Standardizing operations is just as critical when it comes to driving foot traffic through local search, where consistency also pays off.

4. Skipping Shift Change Reconciliation

Here's a scenario that plays out in retail stores every day: one cashier finishes their shift, the next hops on the register, and nobody counts the drawer in between. When the numbers don't add up at closing, there's no way to figure out which shift caused the problem.

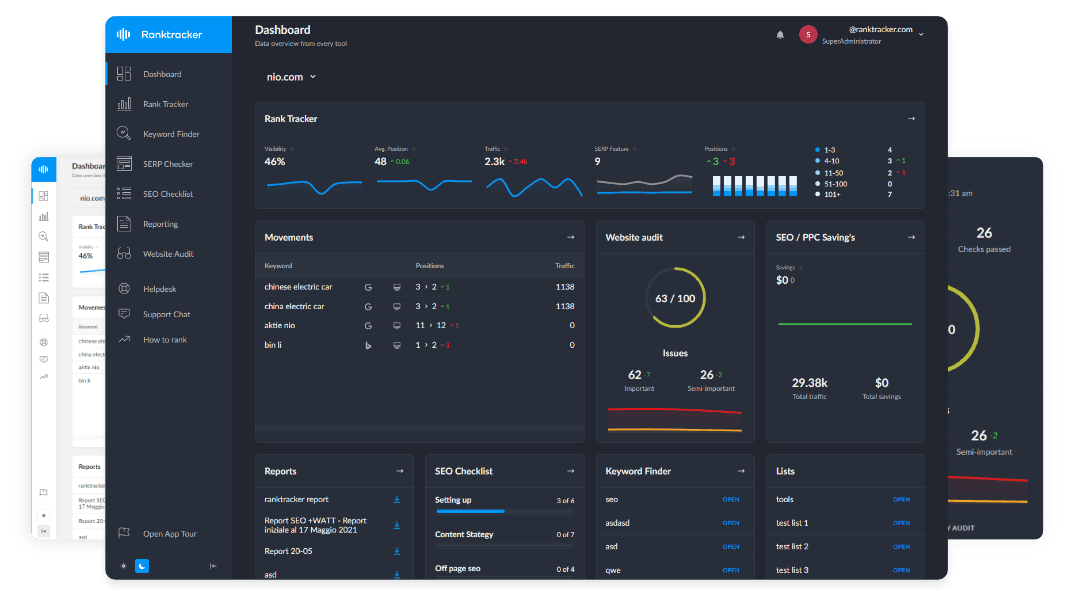

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Each time a drawer changes hands without being counted and verified, it creates a lack of accountability. Those gaps grow over time. The fix is simple: every shift change requires a full drawer count, ideally signed off by both the outgoing and incoming employee. It only takes a few extra minutes but can save hundreds, if not thousands, of dollars in untracked losses over the course of a year.

5. Never Auditing Your Cash Processes

You wouldn't run your business without checking inventory. So why skip auditing cash? Plenty of retail stores only reconcile when there's an obvious problem, which usually means the damage is already done.

Regular cash audits are one of the most effective controls you can implement. According to the Association of Certified Fraud Examiners' 2024 Report to the Nations, roughly one-third of fraud cases happen because companies lack internal controls. They catch errors early and act as a powerful deterrent. Employees are less likely to cut corners when they know cash counts are regularly reviewed.

A simple audit schedule that works:

- Weekly: Spot-check two or three random drawers against POS records

- Monthly: Review all cash deposit records and flag patterns

- Quarterly: Full review of cash handling SOPs and employee compliance

FAQ

How often should I reconcile my cash drawers?

At a minimum, reconcile at the start and end of every shift. If multiple cashiers share a register, count and verify at each handoff. Daily reconciliation is non-negotiable for tracking discrepancies.

What's a reasonable cash drawer limit for a small store?

Between $200 and $500 for most small retailers. The right number depends on your average transaction size, how often customers pay cash, and your area's security profile.

How much do cash handling errors actually cost?

The NRF reported $112.1 billion in U.S. retail shrinkage in 2022, with a significant portion tied to administrative and employee errors, not outright theft. Even daily discrepancies of $5 to $10 can add up to thousands of dollars annually for a single store.

Should I consider going cashless?

Going cashless eliminates cash-handling issues but alienates customers who prefer or need to pay with cash. Many states and cities now legally require businesses to accept it. A better approach is tightening your procedures rather than dropping cash entirely.

What's the single most impactful change I can make?

Implementing written standard operating procedures for cash handling. It creates accountability, gives you a baseline to audit against, and ensures every employee follows the same process. Everything else builds on that foundation.

Key Takeaways

- Manual cash counting wastes labor hours and increases errors. Basic automation can pay for itself quickly.

- Untrained cashiers are one of the biggest sources of preventable cash loss in retail.

- Written SOPs create accountability and make discrepancies far easier to trace.

- Always reconcile drawers during shift changes. Never let a register change hands without being counted.

- Regular cash audits deter fraud and catch problems before they snowball.