Intro

Farmers and agricultural businesses are constantly looking for financial support—whether to purchase equipment, buy land, expand operations, or manage seasonal cash flow. If you provide farm loans, equipment financing, crop funding, or agri-business grants, your potential clients are already searching for your services online.

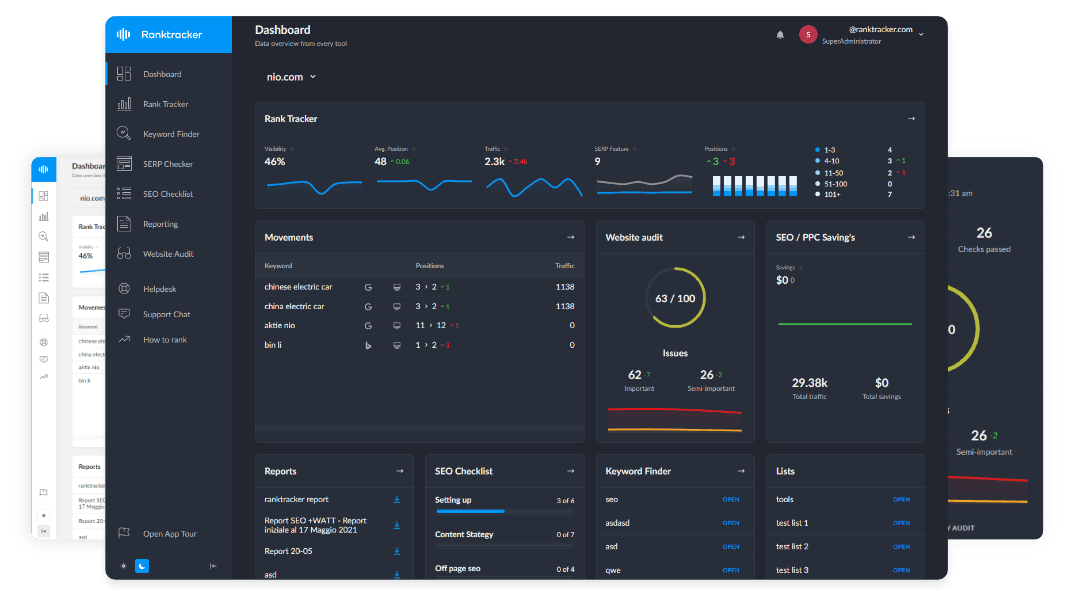

Search Engine Optimization (SEO) ensures your business ranks for important searches like “farm loan providers,” “agriculture equipment financing near me,” or “low-interest crop loans.” With the right SEO strategy, you can become the go-to lender for the ag sector, driving inbound inquiries and loan applications directly from organic search.

Why SEO Matters for Agriculture Finance Companies

Agriculture is a high-stakes, capital-intensive industry—and most financial decisions start with research. SEO helps ensure that your loan offerings are visible and competitive online.

SEO helps you:

-

Rank for funding-related searches like “loan for buying farmland” or “tractor financing for farmers”

-

Reach independent farmers, co-ops, and rural entrepreneurs actively seeking capital

-

Promote special loan programs (e.g., USDA-backed, startup ag loans, low-interest seasonal loans)

-

Build credibility and trust with clear, informative content

-

Generate more online applications and qualified leads

Keyword Research That Matches Funding Needs

Target keywords that align with your services, borrower type, location, and financing purpose. Segment your keywords by product or audience.

High-converting keyword examples:

-

farm loan application online

-

agriculture equipment financing

-

tractor loan with low interest

-

beginning farmer loan program [state]

-

USDA farm loan assistance

-

crop loan provider near me

-

dairy farm expansion loan

-

sustainable agriculture finance solutions

Use Ranktracker’s Keyword Finder to discover long-tail keywords based on borrower type (beginner, commercial, organic, regenerative) and purpose (equipment, livestock, irrigation, infrastructure).

On-Page SEO That Drives Loan Inquiries

Once a user lands on your site, they should find the exact financial product they’re looking for, with a clear path to apply or get more information.

Key on-page SEO strategies:

- Use keyword-optimized headings (H1, H2, H3) like **“Flexible Farm Equipment Loans for Family-Owned Operations”

**

-

Create unique meta titles and descriptions for each financing product or borrower type

-

Develop dedicated landing pages for each offering: land loans, livestock funding, equipment leasing, crop financing, etc.

-

Include trust signals like USDA partnership logos, testimonials, case studies, or success rates

-

Add strong CTAs like “Apply Now,” “Get Prequalified,” or “Talk to an Ag Loan Specialist”

-

Highlight terms, interest rates, repayment periods, eligibility, and required documents

-

Use internal links to connect related products or informational content

A clear, keyword-targeted site structure improves rankings and makes it easier for borrowers to convert.

Local SEO for Regional and Rural Reach

Farmers often prefer lenders who understand their region, climate, and local crops. Local SEO helps you dominate search results in key farming regions.

Local SEO tips:

-

Set up and optimize your Google Business Profile with location, service area, contact info, and photos

-

Use location-specific keywords like “farm loans in [state]” or “agriculture finance company near [town]”

-

Create region-focused landing pages for each state or county you serve

-

List your business in rural development directories, ag co-op networks, and farming associations

-

Encourage client reviews that mention loan types, customer service, and fast approval times

Local visibility builds trust—especially when competing with national banks or lenders without ag specialization.

Content Marketing That Builds Trust & Educates Borrowers

Loan decisions require clarity and confidence. Educational content helps farmers understand their options, trust your expertise, and begin the application process.

Blog and content ideas:

-

“How to Apply for a USDA Farm Loan: Step-by-Step Guide”

-

“Farm Equipment Financing: What You Need to Know in 2025”

-

“Top 5 Agriculture Grants for New Farmers”

-

“What’s the Difference Between a Crop Loan and an Operating Line of Credit?”

-

“Agri-Business Expansion Loans: Funding Greenhouses, Barns & Irrigation Systems”

-

“How Your Farm Credit Score Affects Your Loan Terms”

Use blog posts, video explainers, infographics, and checklists to capture long-tail keywords and build confidence with first-time borrowers.

Visual SEO That Builds Confidence and Professionalism

Agriculture borrowers want to feel secure—they need to see a trustworthy, professional lender with real results.

Visual SEO tips:

-

Use real images of clients, agricultural equipment, and financed farms (with permission)

-

Add alt text like “farmer using tractor financed through our ag loan program”

-

Use filenames like **“farm-land-loan-application-guide.jpg”

**

-

Embed short videos explaining financing options or showcasing success stories

-

Include charts comparing loan options, repayment schedules, or approval timelines

Visual content improves user engagement, reduces bounce rates, and builds lasting trust.

Build Backlinks to Improve Rankings and Authority

Backlinks from trusted ag, finance, and government sources help improve your domain authority and visibility in search results.

Great backlink sources:

-

Agriculture extension offices and ag college programs

-

USDA partner directories or grant networks

-

Guest posts on farming finance blogs or trade publications

-

Listings in financial directories and rural business associations

-

Case study swaps with farm equipment dealers or co-ops

Use Ranktracker’s Backlink Checker to monitor your backlink profile and find new authority-building opportunities.

Monitor SEO Performance & Optimize by Season

Ag financing needs shift throughout the year—align your SEO strategy with planting, harvest, and government funding cycles.

Use Ranktracker to:

-

Track seasonal keywords like “spring planting loan” or “end-of-year farm tax credit funding”

-

Audit your website for mobile usability, page speed, and conversion bottlenecks

-

Monitor top-performing pages for clicks, form submissions, and bounce rate

-

Adapt landing pages and blog content for new loan programs or market changes

-

Create time-sensitive campaigns around grant deadlines or USDA funding rounds

SEO helps you stay ahead of the curve—and in front of farmers when they need you most.

Final Thoughts

Agriculture finance and loan SEO gives you a competitive advantage in a trust-based, seasonal, and highly specialized industry. Whether you're a community lender, USDA partner, or national financing firm, optimizing your website helps you reach the farmers and agri-businesses who need your support to grow.

With clear keyword targeting, locally focused pages, helpful content, and a trustworthy digital presence, your finance business can cultivate real relationships—and become the funding partner rural communities depend on.